📑 Detailed SEO Outline for: how to do financial analysis of a company

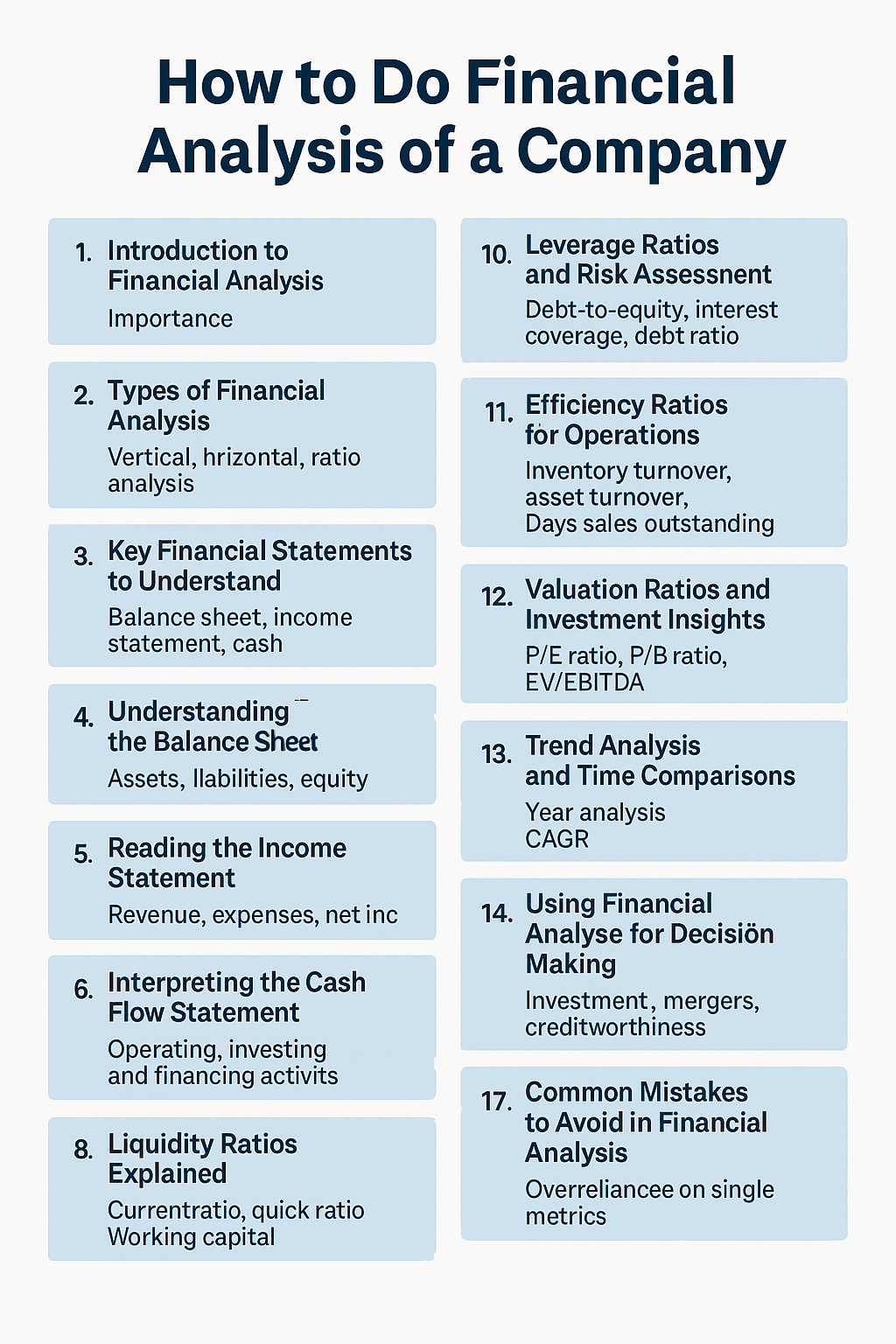

| Main Heading (H2) | Subtopics (H3–H6) |

|---|---|

| 1. Introduction to Financial Analysis | Importance, Purpose, and Who Should Do It |

| 2. Types of Financial Analysis | Vertical, Horizontal, Ratio, Trend, and Cash Flow Analysis |

| 3. Key Financial Statements to Understand | Balance Sheet, Income Statement, Cash Flow Statement |

| 4. Understanding the Balance Sheet | Assets, Liabilities, Equity – Structure and Insights |

| 5. Reading the Income Statement | Revenue, Expenses, Net Income, EBIT, EBITDA |

| 6. Interpreting the Cash Flow Statement | Operating, Investing, and Financing Activities |

| 7. Ratio Analysis: The Heart of Financial Analysis | Liquidity, Profitability, Leverage, Efficiency, and Valuation Ratios |

| 8. Liquidity Ratios Explained | Current Ratio, Quick Ratio, Working Capital |

| 9. Profitability Ratios That Matter | Gross Margin, Net Margin, Return on Equity, Return on Assets |

| 10. Leverage Ratios and Risk Assessment | Debt-to-Equity, Interest Coverage Ratio, Debt Ratio |

| 11. Efficiency Ratios for Operations | Inventory Turnover, Asset Turnover, Days Sales Outstanding (DSO) |

| 12. Valuation Ratios and Investment Insights | P/E Ratio, P/B Ratio, EV/EBITDA, Market Cap to Revenue |

| 13. Trend Analysis and Time Comparisons | Year-over-Year Growth, CAGR, Financial Projections |

| 14. Comparing with Industry Benchmarks | Peer Analysis, Sector Standards, Competitive Positioning |

| 15. Using Financial Analysis for Decision Making | Investment, Mergers, Creditworthiness, Strategic Planning |

| 16. Common Mistakes to Avoid in Financial Analysis | Overreliance on Single Metrics, Ignoring Context |

| 17. Tools and Software for Financial Analysis | Excel, QuickBooks, Tableau, Bloomberg Terminal, Free Online Tools |

| FAQs About Financial Analysis | 6 detailed FAQs answered |

| Conclusion | Final thoughts and practical tips |

1. Introduction to Financial Analysis of a Company

Financial analysis is the backbone of smart decision-making for investors, managers, and stakeholders. Whether you're evaluating a company for investment, credit approval, or strategic planning, understanding its financial health is crucial.

The goal of financial analysis is to assess a company's performance, stability, and profitability using data from financial statements. It's not just about numbers—it's about telling a story through the lens of finance.

2. Types of Financial Analysis

To perform a comprehensive review, it's important to know the different methods of financial analysis:

- Vertical Analysis: Compares items on a single financial statement as a percentage of a base figure.

- Horizontal Analysis: Looks at changes in financial data over time.

- Ratio Analysis: Calculates financial ratios to measure performance.

- Trend Analysis: Observes financial trends across periods.

- Cash Flow Analysis: Examines inflows and outflows to assess liquidity.

Each type offers unique insights and should be used together for a holistic view.

3. Key Financial Statements to Understand

Before diving into ratios and trends, get familiar with the core financial documents:

- Balance Sheet – Snapshot of assets, liabilities, and equity.

- Income Statement – Shows profitability over a specific period.

- Cash Flow Statement – Tracks cash in and out from operations, investing, and financing.

Understanding these statements is the foundation of every good financial analysis.

4. Understanding the Balance Sheet

The balance sheet reveals what a company owns and owes at a specific point:

- Assets: What the company owns (cash, inventory, equipment).

- Liabilities: What the company owes (loans, accounts payable).

- Equity: The owner's share in the company after liabilities are subtracted from assets.

The equation Assets = Liabilities + Equity must always balance. A strong balance sheet shows financial stability and low leverage.

5. Reading the Income Statement

The income statement shows a company’s performance over time:

- Revenue: Total income from sales.

- COGS: Cost of goods sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Rent, wages, marketing, etc.

- EBIT & EBITDA: Measures of operating performance.

- Net Income: The bottom line profit after all expenses.

High profitability often points to efficient operations and pricing power.

6. Interpreting the Cash Flow Statement

The cash flow statement is broken into three sections:

- Operating Activities: Cash from core operations (positive cash flow here is a good sign).

- Investing Activities: Buying or selling assets.

- Financing Activities: Issuing stock, paying dividends, or borrowing funds.

A company can show profits but still have poor cash flow—always analyze this statement closely.

7. Ratio Analysis: The Heart of Financial Analysis

Ratio analysis gives measurable insights into various aspects of a business. It's categorized as:

- Liquidity Ratios

- Profitability Ratios

- Leverage Ratios

- Efficiency Ratios

- Valuation Ratios

We'll go into each category in the next sections to understand their significance.

8. Liquidity Ratios Explained

Liquidity ratios assess a company’s ability to meet short-term obligations:

- Current Ratio = Current Assets / Current Liabilities

- Quick Ratio = (Current Assets - Inventory) / Current Liabilities

- Working Capital = Current Assets - Current Liabilities

A higher ratio suggests better liquidity but excessively high ratios might indicate underutilized assets.

9. Profitability Ratios That Matter

Profitability ratios help measure how effectively a company turns revenue into profit:

- Gross Margin = Gross Profit / Revenue

- Net Profit Margin = Net Income / Revenue

- Return on Equity (ROE) = Net Income / Shareholder Equity

- Return on Assets (ROA) = Net Income / Total Assets

Strong profitability ratios indicate financial health and competitive advantage.

10. Leverage Ratios and Risk Assessment

These ratios assess financial risk:

- Debt-to-Equity = Total Debt / Total Equity

- Debt Ratio = Total Liabilities / Total Assets

- Interest Coverage = EBIT / Interest Expense

Too much debt can lead to financial instability, especially in economic downturns.

11. Efficiency Ratios for Operations

Efficiency ratios evaluate how well a company uses its resources:

- Inventory Turnover = COGS / Average Inventory

- Asset Turnover = Revenue / Total Assets

- DSO (Days Sales Outstanding) = (Accounts Receivable / Revenue) × 365

Efficient companies turn over inventory quickly and collect receivables promptly.

12. Valuation Ratios and Investment Insights

Used primarily by investors, these ratios assess if a company is over- or undervalued:

- Price-to-Earnings (P/E) Ratio = Share Price / EPS

- Price-to-Book (P/B) Ratio = Share Price / Book Value per Share

- EV/EBITDA = Enterprise Value / EBITDA

- Market Cap to Revenue = Market Capitalization / Annual Revenue

These metrics are key in stock market investing and valuation modeling.

13. Trend Analysis and Time Comparisons

Trend analysis tracks performance over time:

- Year-over-Year (YoY) Growth

- Compound Annual Growth Rate (CAGR)

- Rolling Averages

Trends help predict future performance and identify turning points in business cycles.

14. Comparing with Industry Benchmarks

Benchmarking compares a company's performance against competitors:

- Analyze peers in the same sector.

- Use industry averages and ratios.

- Evaluate competitive strengths and weaknesses.

This contextualizes numbers and provides a more accurate picture.

15. Using Financial Analysis for Decision Making

Use financial analysis for:

- Investment decisions

- Mergers and acquisitions

- Credit evaluations

- Strategic business planning

Clear, objective analysis leads to smarter, data-driven decisions.

16. Common Mistakes to Avoid in Financial Analysis

Avoid these common pitfalls:

- Ignoring context or qualitative factors

- Focusing only on short-term metrics

- Overreliance on a single ratio

- Using outdated or inconsistent data

A holistic, cautious approach always wins.

17. Tools and Software for Financial Analysis

Here are some essential tools:

| Tool | Purpose |

|---|---|

| Excel | Custom financial modeling |

| QuickBooks | Accounting and small business data |

| Tableau/Power BI | Data visualization |

| Bloomberg Terminal | Market and financial research |

| Yahoo Finance | Free company financials |

Choose tools based on your level and scope of analysis.

FAQs About Financial Analysis

Q1: How often should financial analysis be done?

A: Quarterly or annually, depending on the business needs or investment frequency.

Q2: Can I do financial analysis without an accounting background?

A: Yes, with some basic knowledge of financial statements and ratios, anyone can start.

Q3: What's the most important ratio to look at?

A: It depends on your goal—investors may prefer ROE or P/E, while lenders prefer current ratio or debt ratio.

Q4: How do I compare companies of different sizes?

A: Use ratios and per-share data to normalize figures.

Q5: Is cash flow more important than profit?

A: Often yes—cash flow shows the actual liquidity, while profit can be distorted by accounting choices.

Q6: Where can I find reliable financial data?

A: Use sources like EDGAR (SEC), Yahoo Finance, or official company reports.

Conclusion

Mastering how to do financial analysis of a company is a game-changer for any business leader, investor, or finance enthusiast. By understanding financial statements, calculating key ratios, and benchmarking against the industry, you gain valuable insight into a company’s true performance.

Start small, practice regularly, and use the right tools to grow your analytical skills. Your financial literacy is one of the best investments you can make.